iowa homestead tax credit application

Section 4252 unnumbered paragraph 2 Code 1989 is amended to read as follows. One entrance may be covered per application.

Apply For Homestead Tax Credit Now

Tax Credits.

. Learn About Property Tax. Download Print e-File with TurboTax. 44 Tax Credit Percentage applied for provided under Iowa Code Section 15293A.

2021 Tax Credit. 2015-2016 Iowa Property Tax Credit Claim Author. Adopted and Filed Rules.

Download Print e-File with TurboTax. 777 518 AN ACT relating to the length of occupancy of the homestead for purposes of the homestead credit and providing an effective date. Learn About Sales.

Discover Dakota County Homestead Application for getting more useful information about real estate apartment mortgages near you. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. In order to receive the residential rate the applicant must have an Iowa Homestead Tax Credit on file with the Decatur County Assessors Office.

A claim for property tax credit may be filed on behalf of a deceased person by the persons spouse attorney guardian or estate executor or administrator. The average median home value is 133000. SENIOR PROPERTY TAX HOMESTEAD EXEMPTION SHORT FORM APPLICATION DEADLINE JULY 15 A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified.

The Department of Veteran Affairs DVA reported that there are 2754 1000 disabled Iowa veterans and that 600 of these veterans own their home. Homestead Property Tax Credit Application. Twelve percent 12 of the taxpayers qualifying investment in a Grayfield site.

701801425 Homestead tax credit. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Revised 12202006raf The following HomesteadFarmstead Exclusion application is being provided.

It is a tax credit funded by the State of Iowa for qualifying homeowners and is based on the first 4850 of actual value of the homestead. If two or more persons occupying a home qualify for a credit each person may file a claim based on. Fifteen percent 15 if the Grayfield project meets the requirements of green development.

HOMESTEAD TAX CREDIT HF. File With Confidence Today. If you are in a nursing home but still own and maintain your homestead you can apply for the property tax credit.

Download Print e-File with TurboTax. To apply for the tax credit an investor in a project which cannot be a city or a county must submit an application to the Iowa Economic Development Authority EDA. 2 Claims a homestead credit or military tax exemption on a home in Iowa or 3 Is registered to vote in Iowa or 4 Maintains an Iowa drivers license or 5 Does not reside in an abode in any other state for more days of the tax year than the individual resides in Iowa.

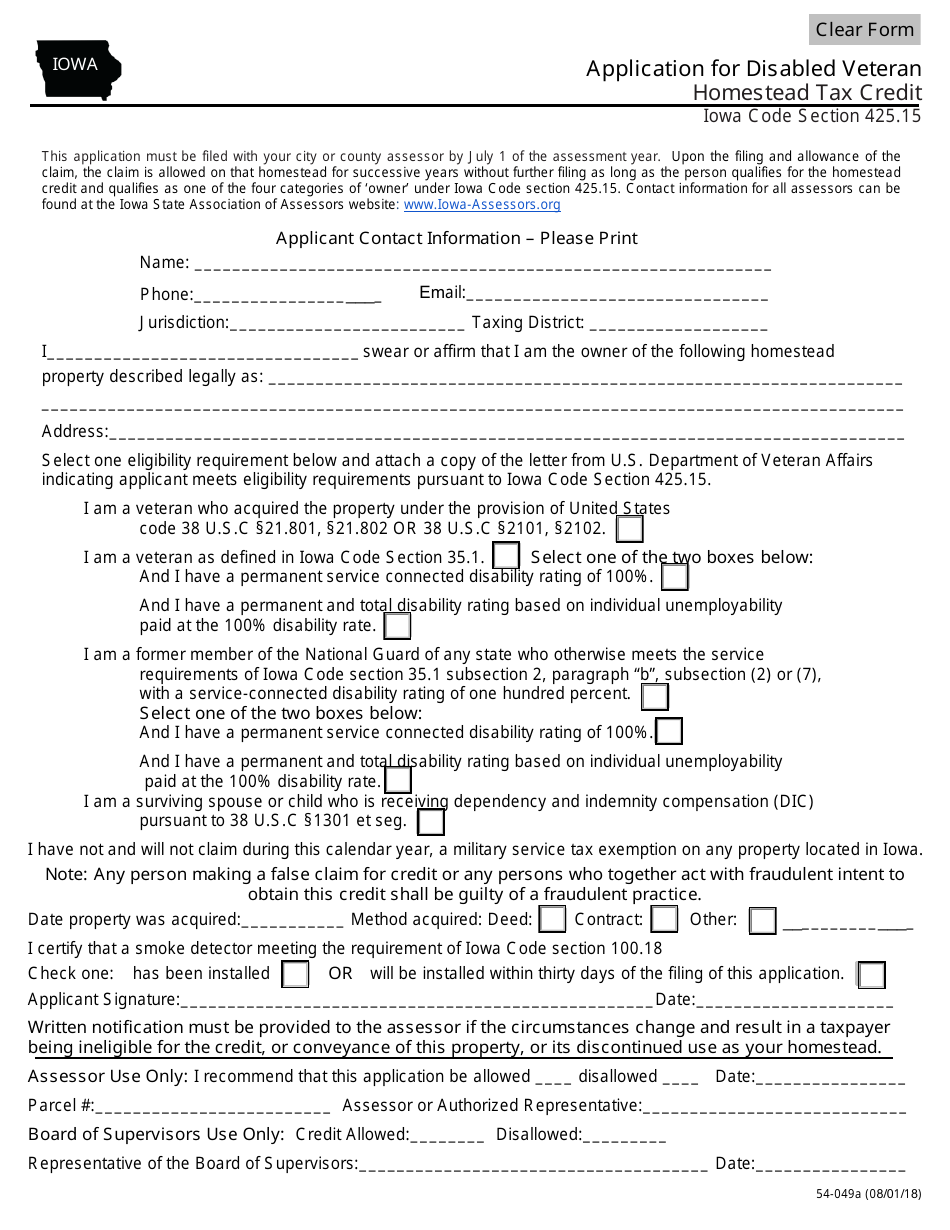

No homestead tax credit shall be allowed unless the first application for homestead tax credit is signed by the owner of the property or the owners qualified designee and filed with the city or county assessor on or before July 1 of the current assessment year. 8011 Application for credit. The homestead credit is a property tax credit for residents of the state of Iowa who own and occupy their homestead on July 1 and for at least six months of the calendar year.

Business Property Tax Credit Application. To apply for rent reimbursement you will need to find out from the nursing home how much of your total payment is for rent. 2021 Tax Credit.

Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. File a W-2 or 1099. No Tax Knowledge Needed.

Assumes the State will fully fund the Homestead Property Tax Credit this includes the Disabled Veterans Homestead Tax Credit. Be It Enacted by the General Assembly of the State of Iowa. Note that applications are due by March 15th 2015.

The homestead credit fund shall be apportioned each 1 12 year so as to give a credit against the tax on each eligible 1 13 homestead in the state in an amount equal to the actual levy 1 14 on the first four thousand eight hundred fifty dollars of 1 15 actual value for each homestead allowable homestead value. Iowa Special Property Tax Assessment Credit. Files an application that is false to any material matter shall be subject to payment of taxes due plus interest plus penalty and shall be subject to prosecution as a misdemeanor of the third degree and a fine of up to 2500.

To be eligible the deceased person must have been an Iowa resident at the time of death. Sate of Iowa Created Date. There are three basic requirements to qualify.

Dakota County Homestead Application - Real Estate Apartment Mortgages Informations. Law. Residents of Decatur County will be charged 25 per application and non-residents will be charged 100 per application.

The application can be found at httpstaxiowagovsitesfilesidrforms154024_0pdf. Do Not Show Again Close. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

If you live in a nursing home and no longer own a home you may be eligible for rent reimbursement. For more information on the Business Property Tax Credit including the application form visit the Departments website at wwwtaxiowagov2013-property-tax-reform. In the case of a Disabled Veteran Tax Credit the value of the Homestead Credit is increased to the entire amount of the Table Value of the property.

1 The qualifying senior. Ad Free tax support and direct deposit. Homestead Tax Credit.

Answer Simple Questions About Your Life And We Do The Rest.

Form 54 049a Download Fillable Pdf Or Fill Online Application For Disabled Veteran Homestead Tax Credit Iowa Templateroller

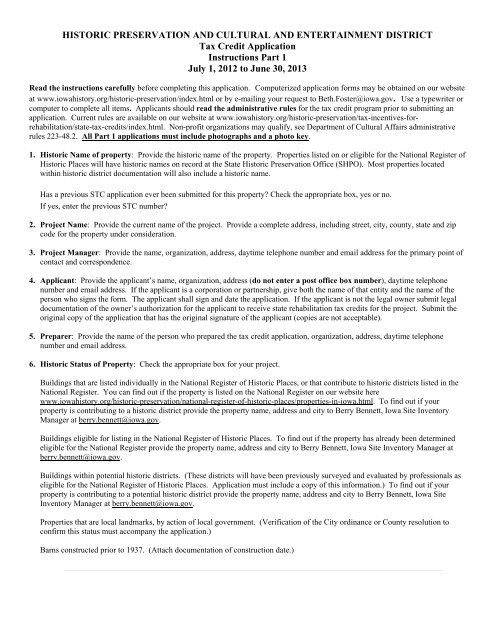

Iowa Property Tax Credit Certification Application State Historical

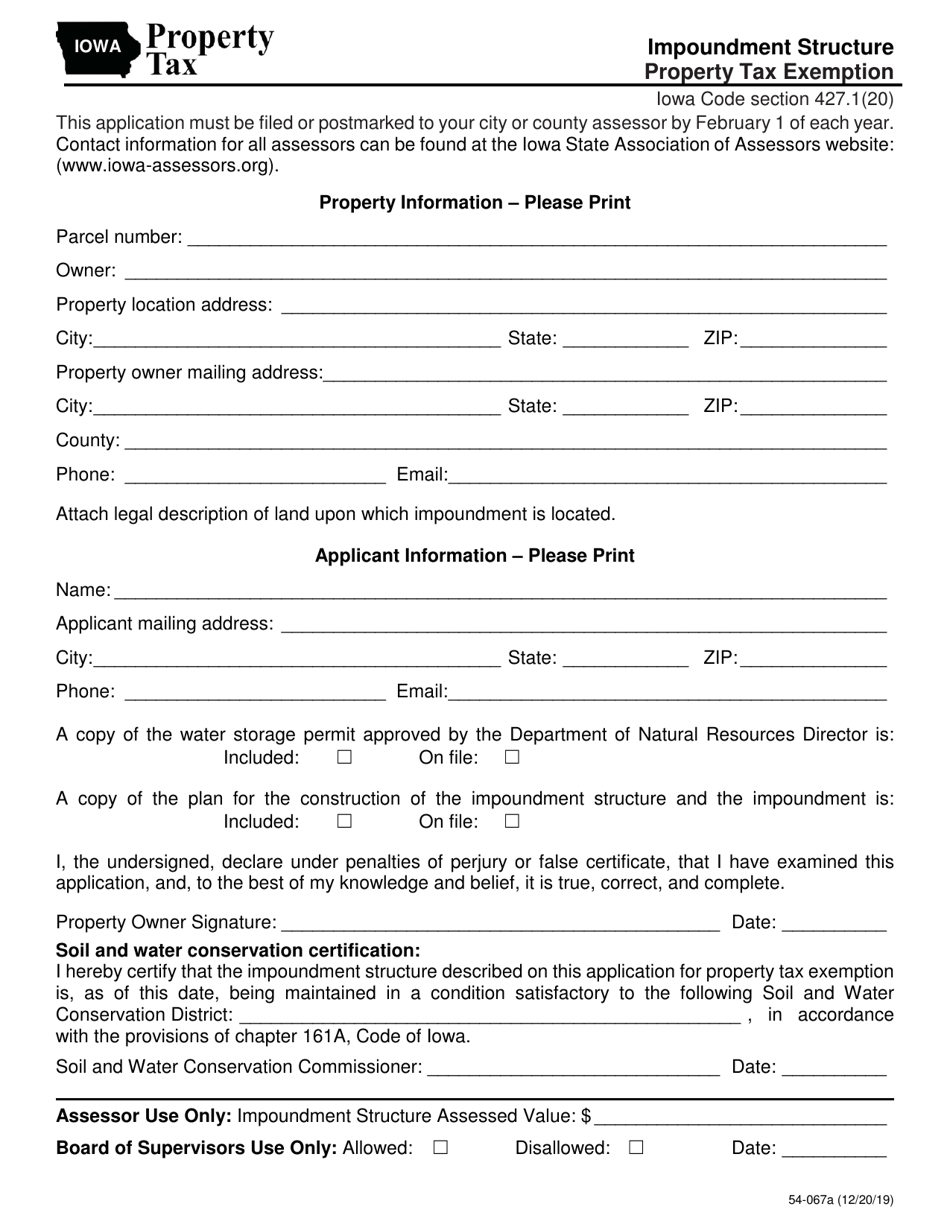

Form 54 067 Download Printable Pdf Or Fill Online Impoundment Structure Property Tax Exemption Iowa Templateroller

Fill Free Fillable Forms State Of Iowa Ocio

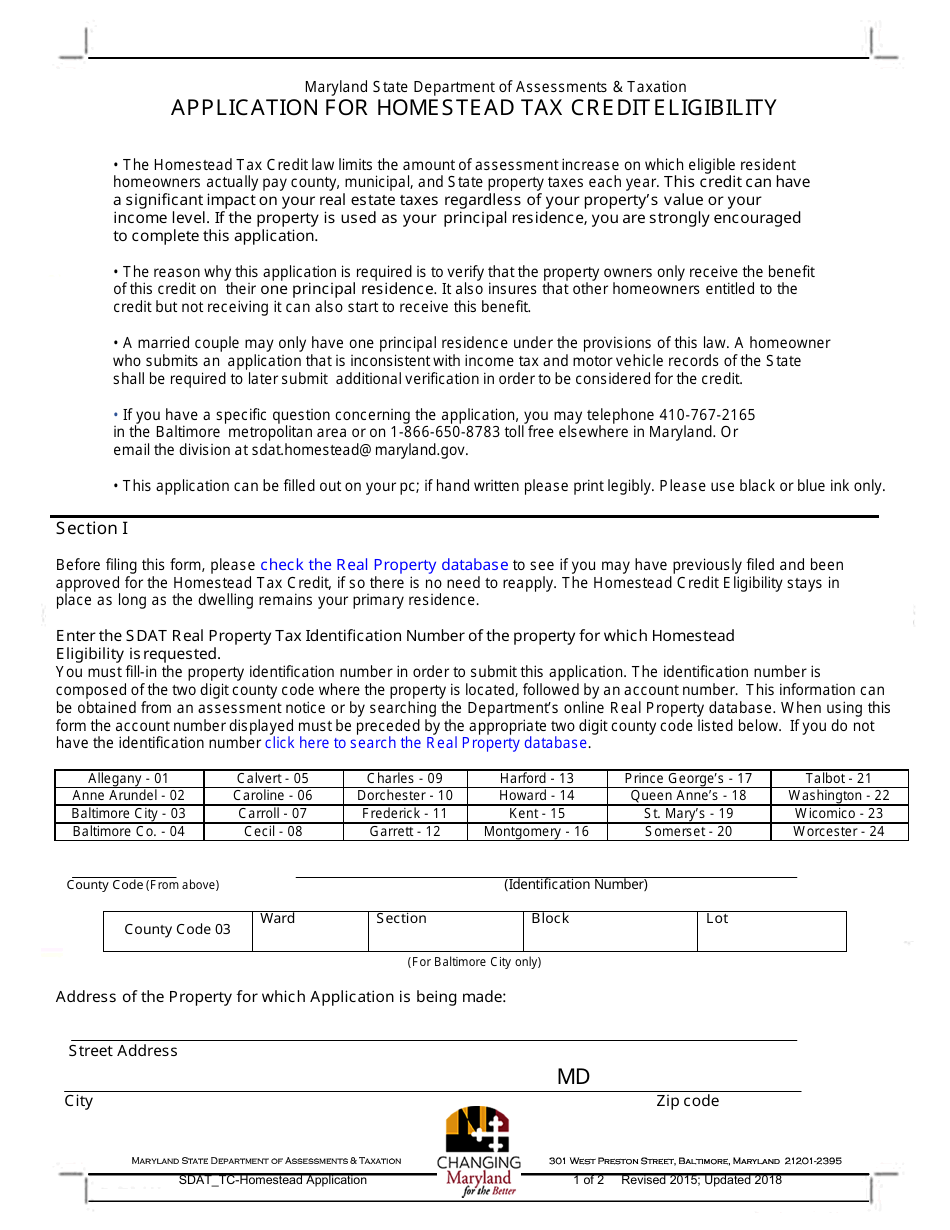

Maryland Application For Homestead Tax Credit Eligibility Download Fillable Pdf Templateroller

Homestead Credit Reminder Hokel Real Estate Team

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Form 54 049a Download Fillable Pdf Or Fill Online Application For Disabled Veteran Homestead Tax Credit Iowa Templateroller

Update Regarding Homestead Tax Credit Applications Laughlin Law Firm Plc Jason Laughlin Managing Attorney

Apply For Homestead Tax Credit Now

What Is A Homestead Exemption And How Does It Work Lendingtree

Jackson County Assessor Office Application For Homestead Tax Credit

Form 59 458 Fillable Homestead Tax Military Service Credit Notice Of Transfer Or Change In Use Of Property