mississippi state income tax rate

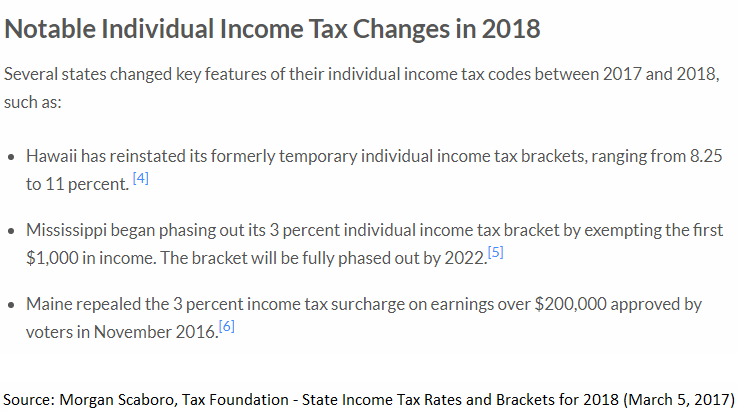

Your Guide to State Income Tax Rates Income tax rates run from 0 to more than 13. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent.

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi also has a 400 to 500 percent corporate income tax rate.

. There is no tax schedule for Mississippi income taxes. Corporate Income Tax Division. Corporate and Partnership Income Tax Help.

3 on taxable income from 4001 to 5000 High. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Any income over 10000 would be taxes at the highest rate of 5.

3 on the next 3000 of taxable income. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets. The graduated income tax rate is.

5 rows Mississippis sales tax rate consists of a state tax 7 percent and local tax 007. The state income tax in Mississippi will begin its slow four-year decrease from 5 to 4 on July 1st. The tax which applies to all income above 5000 will reduce first to 47.

How do I compute the income tax due. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate of tax for an. 0 on the first 2000 of taxable income.

3 on the next 2000 of. Mississippi has a graduated income tax rate and is computed as follows. 0 on the first 3000 of taxable income.

Mississippi Income Taxes. Because the income threshold for the top. As you can see your income in Mississippi is taxed at different rates within the given tax brackets.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Detailed Mississippi state income tax rates and brackets are available on. 4 rows The Mississippi income tax has three tax brackets with a maximum marginal income tax of.

Welcome to The Mississippi Department of Revenue. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Mississippi Income Tax Range.

Mississippi State Single Filer Tax Rates Thresholds and Settings. 3 rows For single taxpayers living and working in the state of Mississippi. 4 on the next.

Mississippi Income Taxes. Tax rate of 0 on the. 5 on taxable income over 10000.

Mississippi State Personal Income Tax Rates and Thresholds in 2022. Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 S Corporation. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

Detailed Mississippi state income tax rates and brackets are available on. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi.

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Will Mississippi Join The No Income Tax Club

State Tax Levels In The United States Wikiwand

State Income Tax Data Updated For 2018 Now Available In Total Moneytree Software

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Top States For Business 2022 Mississippi

Mississippi Income Tax Calculator Smartasset

State Income Tax Rates Highest Lowest 2021 Changes

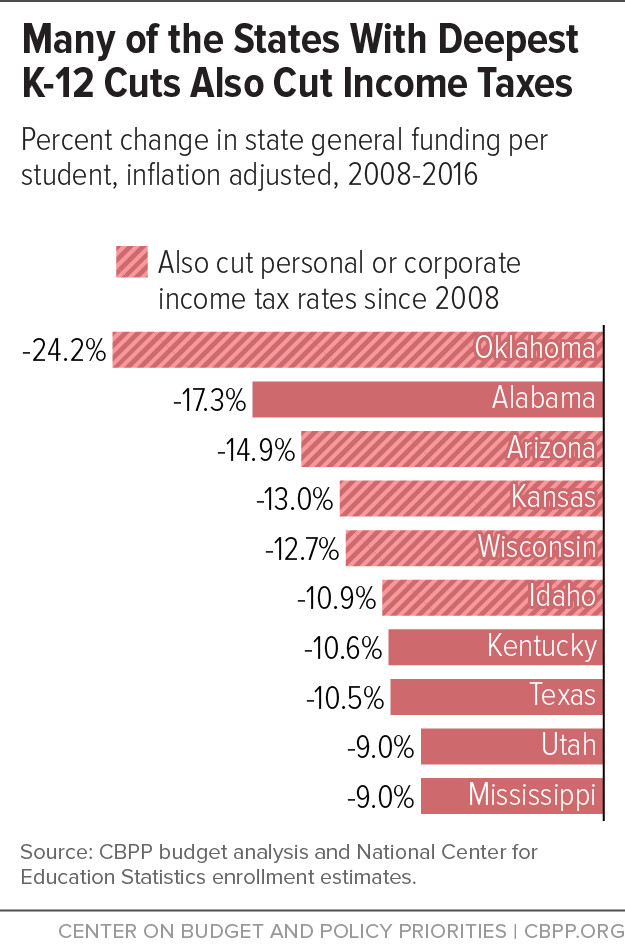

Mississippi Tax Cuts Would Worsen Education Squeeze Center On Budget And Policy Priorities

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

The Most And Least Tax Friendly Us States

How To Form An Llc In Mississippi Llc Filing Ms Swyft Filings

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Pdf Adjusting Discount Rates For Income Taxes And Inflation A Three Step Process

Mississippi Retirement Tax Friendliness Smartasset

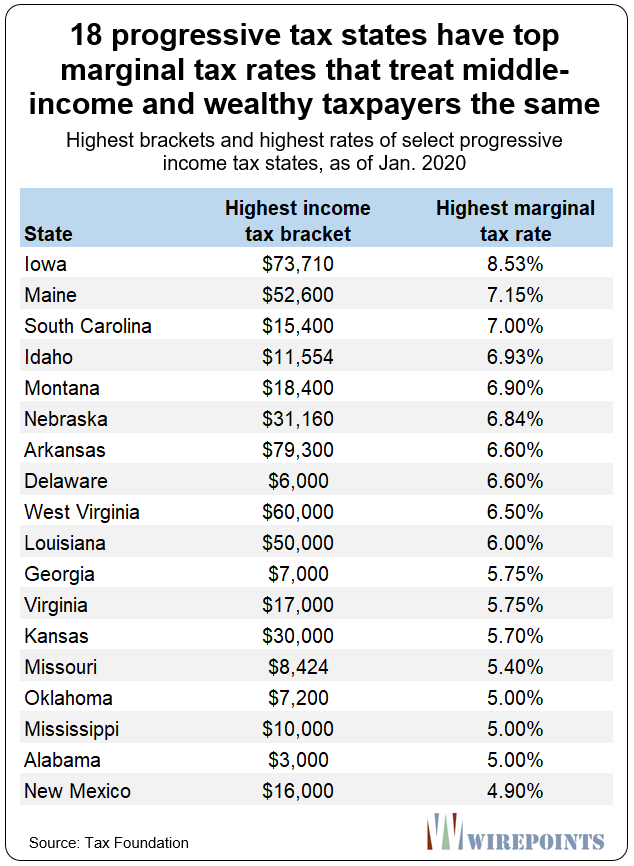

18 Progressive Tax States Have Top Marginal Tax Rates That Treat Middle Income And Wealthy Taxpayers The Same1 Wirepoints

Every State With A Progressive Tax Also Taxes Retirement Income

![]()

Mississippi Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy